Smart DCA Strategy

SDCA adapts DCA by sizing each buy from market sentiment and risk

Overview

SDCA is an improvement on classic DCA, which invests at a fixed interval. Instead of always investing the same amount, SDCA adjusts the amount per execution based on market sentiment.

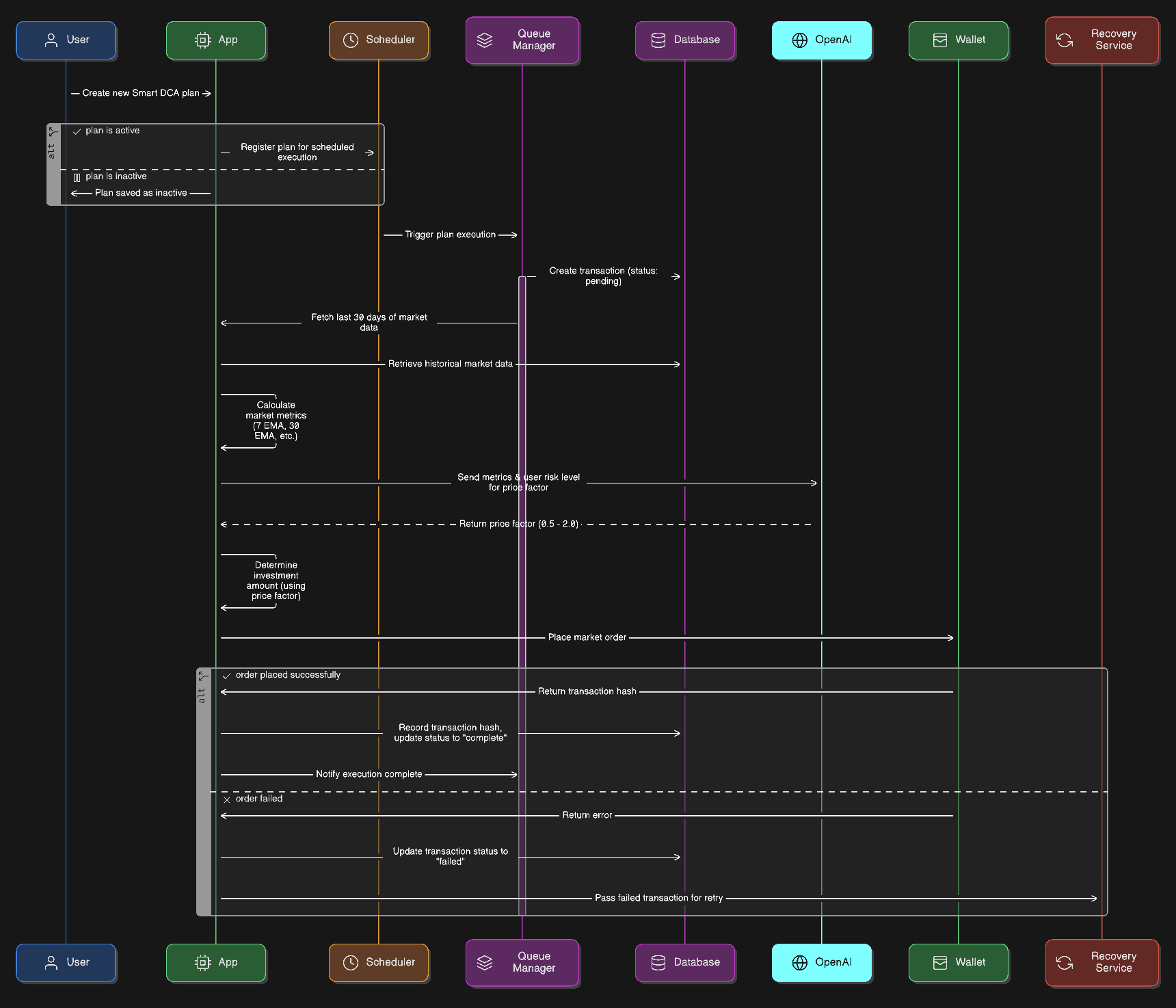

Execution diagram

How SDCA differs from DCA

- Fixed schedule, variable size: timing stays periodic, size adapts

- Uses sentiment to scale the buy up or down

- Respects user risk bounds to avoid extreme sizing

Price factor (sentiment multiplier)

We derive a price factor from market sentiment via OpenAI. The price factor is a multiplier in the range [0.5, 2] that determines what fraction of the daily investment to allocate for the current execution.

- Lower expected opportunity → smaller factor

- Higher expected opportunity → larger factor

The factor is computed from metrics such as 30MVA, 7MVA, 30EMA, 7EMA and related trend/volatility signals. A user-selected Risk Level sets the upper and lower bounds that clamp the factor.

Formula:

Optimal Investment = Daily Investment × Price Factor (bounded by risk level)Risk level

- User chooses a risk level that defines min and max bounds for the price factor

- Higher risk allows larger swings in allocation within the [0.5, 2] range

Environments

We run SDCA in two environments:

- Mock: operates on past data (typically a 90‑day window)

- Live: executes in real time using the user’s wallet

Note: mock transactions are not stored in the database to avoid clashes with live state.

Live environment flow

- User creates a plan

- If the plan is active, it is scheduled via cron for its execution time

- At execution time, the job is added to the queue manager

- Queue manager runs the task when a slot is available, in order:

- Create a transaction entry in the database with status pending

- Fetch the last 30 days of data

- Calculate metrics

- Fetch price factor from OpenAI using the computed metrics (sentiment)

- Place a market order to buy the decided quantity

- Update the

txHashand set status complete or failed - Failed transactions are sent to the recovery service for retries

Mock environment: batching and deduplication

Mock runs on historical data. If many users run mock on the same chain and token (with different amounts), we optimize by deduping and batching:

- OpenAI batching computes price factors for 90 days in minimal time

- Dedup links new plans to existing batches when parameters match

- With enough existing plans, most requests reuse prior results and incur no OpenAI overhead

Without batching and dedup, a single 90‑day plan would require about 90 sequential OpenAI calls under a minute, which is rate‑limit prone and costly.

Parameters used for dedup

- Token symbol

- Risk level

- Chain

Amount is not used, since the same factor can be multiplied by different daily investments. With coverage across those three parameters, the hit rate approaches 100 percent.

Mock workflow

- User creates a plan

- Check if an OpenAI batch with the same parameters exists

- If it exists, link this plan to that batch

- Otherwise, create a new OpenAI batch

- Fetch 120 days of data (extra 30 days to seed the first point)

- Calculate metrics for each day across 90 days

- Send a

.jsonlbatch to the OpenAI batch processor - Return batch status (pending or data)

- Query the batch for updates whenever a request is made